Vehicle Technology - Winter 2019

December 3, 2021

6 minute ReadBy Derek Kaufman

Recently, a series of tweets and articles began to circulate about Tesla’s warning to their owners on the use of automatic car washes and the possible impact to an owner’s warranty coverage. The initial warning was included in a thread in the www.model3club.com forum, which simply restated a section of the Model 3 owner’s manual as follows:

“Caution: If washing in an automatic car wash, use Touchless car washes only. These car washes have no parts (brushes, etc.) that touch the surfaces of the Model 3. Using any other type of car wash could cause damage that is not covered by the warranty.”

The manual section, entitled “Cautions for Exterior Cleaning,” also recommends that owners “do not use hot water or detergents” and cautions against high-pressure water.

Internet communication being what it is, that forum admonition grew into completely incorrect concerns on the impact of car washes on electric drive cars, which led to articles on the growth of battery electric vehicles (BEVs) and a larger impact on the car wash industry. So, we thought we’d spend some time in this article to address these concerns and also shed some light on BEV growth in the automotive industry.

First, ICA responded quickly to clarify Tesla’s owner’s manual statement by issuing a press release that clearly states that automatic washes do not pose a warranty problem for Tesla owners. ICA called on Tesla to improve the car wash setup procedures for their vehicles. It should be noted that Tesla may actually be listening – there is a website called TeslaTap User Quick Guide (https://teslatap.com/guest/sd-us/car-wash.php) that gives instructions on how to place Tesla vehicles in NEUTRAL and raise the ride height for car washes. Plus, the recent release of their V10 software includes a video (www.tesla.com/blog/introducing-software-version-10-0) with a subliminal listing of upcoming features which shows “Car Wash Mode” in the future lineup. Tesla has not turned that switch on yet, but V10 apparently has the ability to preset Tesla vehicles for car washes. We’ll report that win when we see the Car Wash Mode function flagged on, hopefully in the near future.

Secondly, while the Tesla owner’s manual statement actually has nothing to do with the car being electric drive, concerns have been voiced about the effects of underbody washing on BEVs. There should be no concern. All electric drive vehicles are built to IEEE standards that govern the way cable connectors handle direct water pressure and no BEV should have problems with car wash body or underbody spray systems.

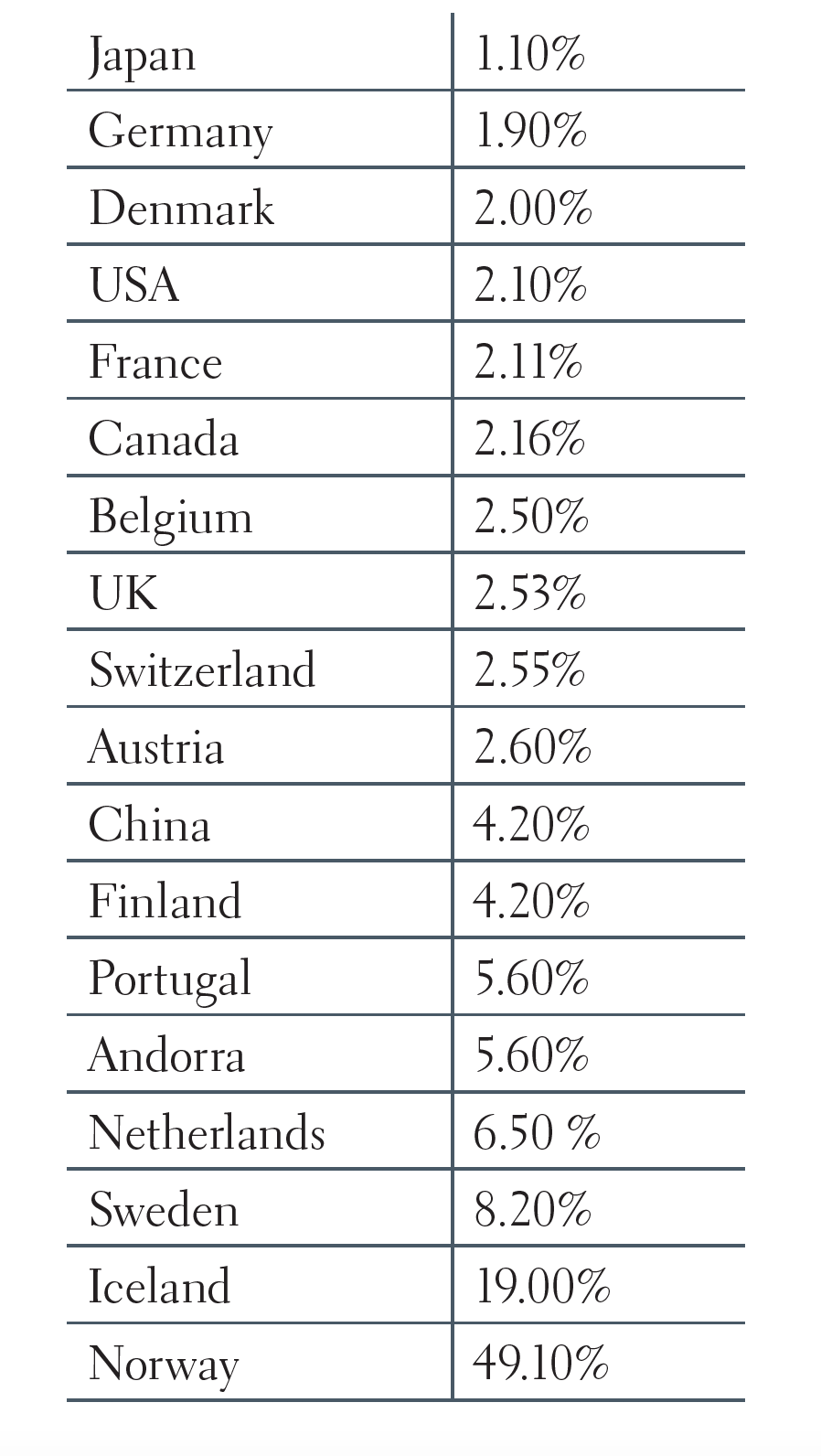

Relative to BEV sales growth, there is growing pressure from various global sources to increase the electric drive portion of vehicles in operation, but the world’s leading BEV markets might surprise you. For 2019, here are the percentages of total vehicle sales that are full BEV (no internal combustion engine powering the vehicle):

For you Californians, we note that BEVs will be about 8.2% of vehicle sales in your state this year.

Look for the European numbers to increase starting in 2020. The current CO2 emission average for European vehicles is 120.5 grams per kilometer. About 95% of all vehicles in Europe will need to meet a new level of 95 grams by the end of 2021. The standards then reduce an additional 15% by 2025 and extend to 37.5% by 2030. Sales of BEVs will need to triple to 6% of European sales to meet these standards. Eventually, these moves in Europe will be seen in the USA as European brands move their global platforms to be EU compliant.

We have also noted some other industry activity related to the pending growth of BEV sales.

Continental AG, one of the world’s leading auto parts suppliers, has announced it will no longer invest in the development of new internal combustion engine components or systems, opting instead to expand its role in electric powertrains.

Mention electric drive cars and most people will reference Tesla as the leading BEV brand, but actually, Volkswagen is the leading OEM in terms of EV commitment, investment and projected production. VW is investing €34 billion in its MEB program which will supply a platform of BEV components for the full range of VW models and also offer them to other brands that want to electrify. The company plans to launch 70 new BEV vehicles in the next 10 years with 22 million vehicles being produced during the period. VW says 50% of its BEV production will go to China, 30-40% to Europe and 10-20% to the USA market. To promote the sales of BEV units, VW has partnered with Ford, Daimler and BMW to co-found Ionity, a producer of electric car charging stations, which will install over 400 charging stations in Europe in 2020.

Fiat Chrysler (FCA) has been actively seeking a partner or merger for the last several years and is currently spending hundreds of millions on emission credits purchased from Tesla to be emissions complaint in Europe. FCA is now talking with PSA (the maker of Peugeot vehicles) about a merger of the firms that would create a $50 billion enterprise producing nearly 9 million vehicles each year with brands including Alfa Romeo, Citroen, Jeep, Opel, Peugeot and Vauxhall. That would place the combined company fourth in world production behind Volkswagen, Toyota and Renault-Nissan.

Mazda has been a leader in the development of highly efficient gasoline engines in the last decade but that is changing with its announcement of the Mazda MX 30 BEV, a $37,800 model aimed at the European market. The car is scheduled to begin production in 2020 but there are no plans to bring it to the USA market at this time.

Toyota was early to the electric drive party with its launch of the hybrid Prius for worldwide production in 2000, but it has been slow to introduce new BEV models. Now the company has partnered with China’s Contemporary Amperex Technology Co Ltd (CATL) and electric vehicle producer BYD for battery procurement to ramp up its BEV production. CATL is a world leader in lithium ion battery supply with Honda, Nissan and Volvo as customers. Toyota has also partnered with Subaru to split the costs of development of a BEV SUV that will be sold under both brand names.

The growth of BEVs in the United States may not be driven by vehicle desirability as much as by governmental mandate. Sen. Charles Schumer, the Senate’s minority leader, recently announced a new $462 billion electric car incentive plan he will push if the Senate turns to a Democrat majority in the next election. He stated that the majority of the money would fund a rebate program for people trading in gasoline cars for BEV models while $45 billion would fund expansion of electric charging and $17 billion would support OEM BEV development programs.

Derek Kaufman is a Managing Partner at Schwartz Advisors (SA). SA is a team of highly experienced auto aftermarket experts working with clients in corporate growth projects and both buy-side and sell-side merger and acquisition activities. As part of its growth consulting work, SA keeps current with the emerging technologies and business models that will drive the future supply of automotive parts and service. The reference to any specific commercial products, processes, or services by trade name, trademark, manufacturer or otherwise, does not necessarily constitute or imply its endorsement, recommendation, or favoring by ICA or Schwartz Advisors. The views and opinions of the author do not necessarily state or reflect those of the ICA staff.