6 Insights into Why Car Washing Is at an All-Time High

September 22, 2023

5 minute ReadWe live in a world that doesn’t just like things to be easy and convenient. Consumers demand it — at least that is what the results of the ICA U.S. Consumer Pulse Study say…

By Bob Klein, ICA Research Director

It’s an irrefutable fact.

Americans care about a clean vehicle. A lot.

Ninety-six percent of U.S. car owners and lessees washed their vehicle at least once in the past year. But it’s where consumers wash most often that’s most telling.

Eighty-nine percent washed at a professional car wash, an all-time record high.

Consumer enthusiasm in the most important place of all — sales — is also at a record high, and that number is one operators and vendors are taking to the bank: $13.7 billion. That’s the number that car wash retail sales reached at year-end 2022, ICA estimates.

This penetration and usage data comes from the 2023 ICA U.S. Consumer Pulse Study, the latest chapter in a research history that began in 1996. Conducted February 3-11, 2023, the International Carwash Association Pulse® research consisted of an online survey of 2,089 U.S. adults ages 18+ who own or lease a vehicle and have washed it at least once in the past year. The survey sample is census balanced (representative of the U.S. population) with a +/- 1.9% margin of error.

Six key observations and insights that emerged from this consumer survey tell a statistical story about consumers’ preferences, the impact of emotions and what drives their decisions when it comes to keeping their cars clean.

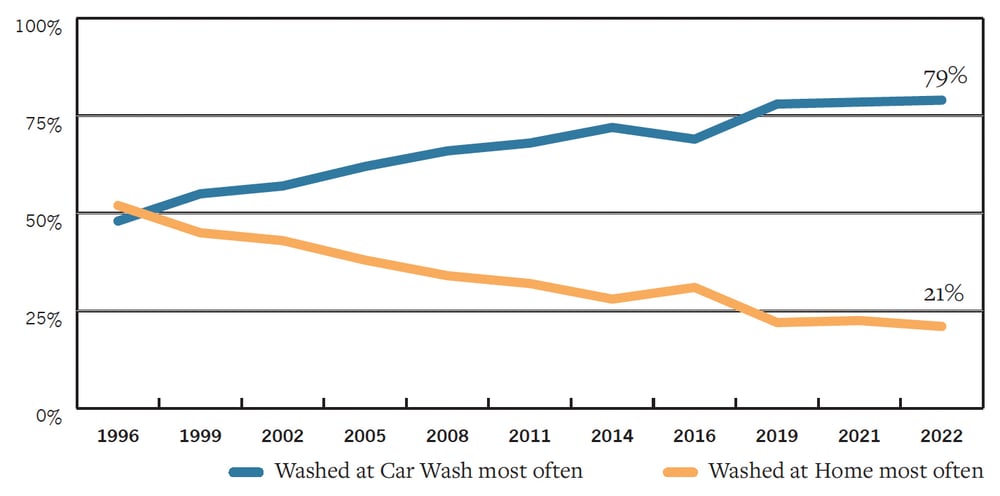

1. America’s preference for washing at a car wash versus washing at home is a business owner’s dream success story.

This graph demonstrates the dramatic growth in preference. In 1996, 52% of consumers washed at home most often. In 2023, home washing has declined by 60%, as preference for a car wash skyrocketed to 79%.

We live in a world that doesn’t just like things to be easy and convenient. They demand it. It’s pervasive. Eighty-three percent of consumers say convenience while shopping is more important now compared with five years ago. Car washes couldn’t be more on-trend and relevant.

2. Washing is rooted in deep emotions.

We’ve heard it loud and clear over the years, in our own experiences and our ICA consumer research. But in this year’s research, we asked a different kind of question. We asked car wash customers for just two words that best describe how they feel when they haven’t washed their car for a while. The results reflected practicality but with an emotional twist.

In order of magnitude, they used words like dirty, gross and messy. Interestingly, though, were the emotionally-charged sentiments attached to their responses: from lazy, anxious and disgusted to embarrassed, ashamed and neglectful.

It’s a classic example of how purchase decisions are made in both the head and heart. And we know that the most compelling, enduring and long-term relationships are rooted in the heart.

3. Percentage of extremely satisfied subscription members is climbing.

Seventy-seven percent of subscription members are extremely satisfied, an increase of seven points from just one year ago. So it's no surprise that anticipated churn is low and consistent with business-to-consumer norms. Only 5% of members say they intend to cancel their subscription in the next month. Eighty-seven percent intend to renew their membership (unchanged from 2022).

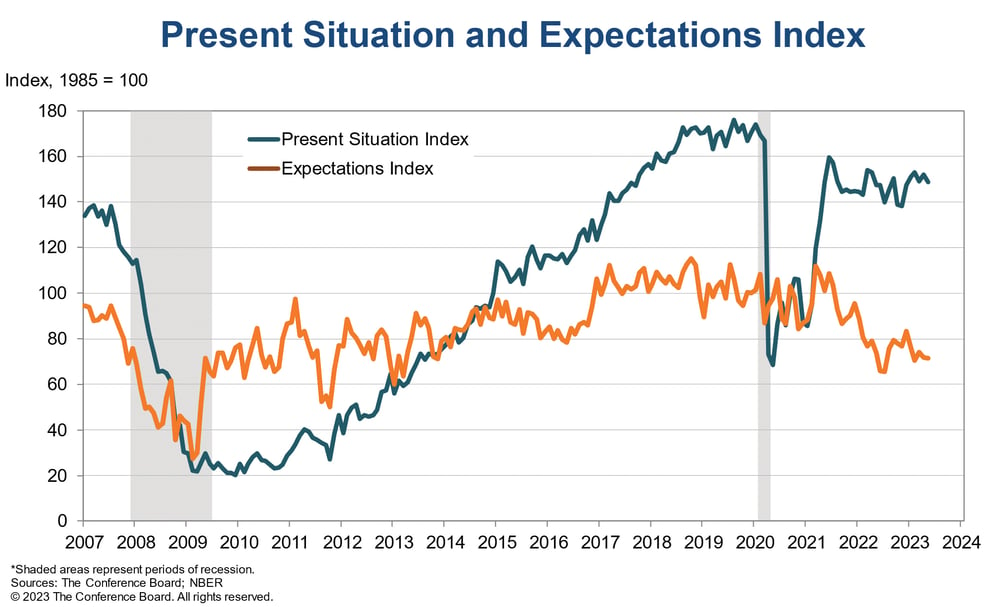

The watch out is price. That’s where the 8% of members who say they’re not sure they will renew could be at risk. It ties directly to the current state of consumer confidence. Through May, the Conference Board Consumer Confidence Index® has declined as consumers’ view of current conditions became somewhat less upbeat while their expectations remained gloomy.

According to Ataman Ozyildirim, senior director of economics at The Conference Board, “consumer confidence has fallen across all age and income categories. Consumers remained pessimistic about the short-term business conditions outlook.”

4. Subscription members are happier than transactional ones.

Only 52% of transactional customers are extremely satisfied versus 77% for subscription customers. There are two key watch outs for operators. Similar to subscription members, customers are concerned about price per wash. Compared to members, only 30% of transactional customers are extremely satisfied, down 13% from a year ago. And price per wash ties to their satisfaction with value, down 10 points from last year to 35%.

Nevertheless, when it comes to washing their vehicle, there’s no anticipated change in their behavior. Ninety-two percent intend to wash the same amount or more often. There’s no doubting just how important a clean car is to America.

5. Brand matters less when it comes to revenue and profit-rich value-added products?

As perspective, in 2022 ICA conducted the first-ever study on the value of a car wash brand — and found that brand names matter. This quantitative test revealed that the right brand can increase preference by 39%. Most importantly, willingness to pay more was 43% higher compared to more generic brand names.

This year, we posed a similar question for value added products, the first-ever study on the value of brand names for value-added products or services. On average, 62% of consumers say it's important that car washes offer these products. But are consumers willing to pay more?

In 9 of 10 categories, consumers’ willingness to pay more for a leading brand was equal to or lower than the unbranded product descriptor. The lone exception was rain repellant for headlights. This finding highlights the need to educate consumers on the benefits of branded value-added products.

6. Several ideas offer opportunities to drive growth.

In addition to increasing willingness to pay more for value added products, the survey queried participants on a variety of new ideas suggested by the ICA member advisory group. Two ideas generated 50% or greater interest.

• A car wash that uses only environmentally friendly cleaning products.

• A car wash that recycles its water, reducing the amount of fresh water needed and the amount of waste being released into the environment.

The biggest single opportunity is among subscription members. Sixty-five percent are interested in a discount for additional vehicles added to memberships (i.e., third-vehicle free). It’s another great opportunity to fuel membership growth and loyalty.

The Consumer Pulse

More detailed findings are available in The Consumer Pulse, March 2023 edition, and the next edition coming October 2023, which are available for purchase at a significant discount for ICA members: www.carwash.org/pulse. You can join ICA and become a member at www.carwash.org/join.